- Startup Loan Options Outside Of Venture Capital Management

- Startup Loan Options Outside Of Venture Capital Group

- Startup Loan Options Outside Of Venture Capital Companies

Raising outside capital to scale a startup or e-commerce business has often been a reality for just one racial group with 90 percent of Silicon Valley venture capital funding going to companies led by white men.

Start-up business loans are offered by financial institutions to help business owners with a new business’s costs. While they’re a great concept, start-up business loans can be quite challenging to acquire. These loans are risky for lenders, so the approval process can be laborious. Luckily, there are many options to consider. Some of the top ways to raise capital are through angel investors, venture capitalists, government grants, and small business loans. There are other methods for financing such as credit cards or invoice financing, but these should be used only if you need cash quickly and know the risks involved. There are options to keep your equity. Here are six startup and e-commerce financing alternatives to venture capital. Brex has created a corporate charge card for early-stage startups that rejects traditional underwriting methods. Instead of credit scores, it focuses on the funding of the business itself, Nerd Wallet reported. Funding for Startups: 12 Best Options for Raising Money Startup Law Resources Venture Capital, Financing. Figuring out the best way to fund your startup is difficult. Here we outline 12 of the best sources of funding that you can leverage to launch your startup. Alternative Funding Options For Startups Besides Venture Capital. That outside investor funding is not a realistic option for most startups. Your early-stage startup. Bank loans, credit.

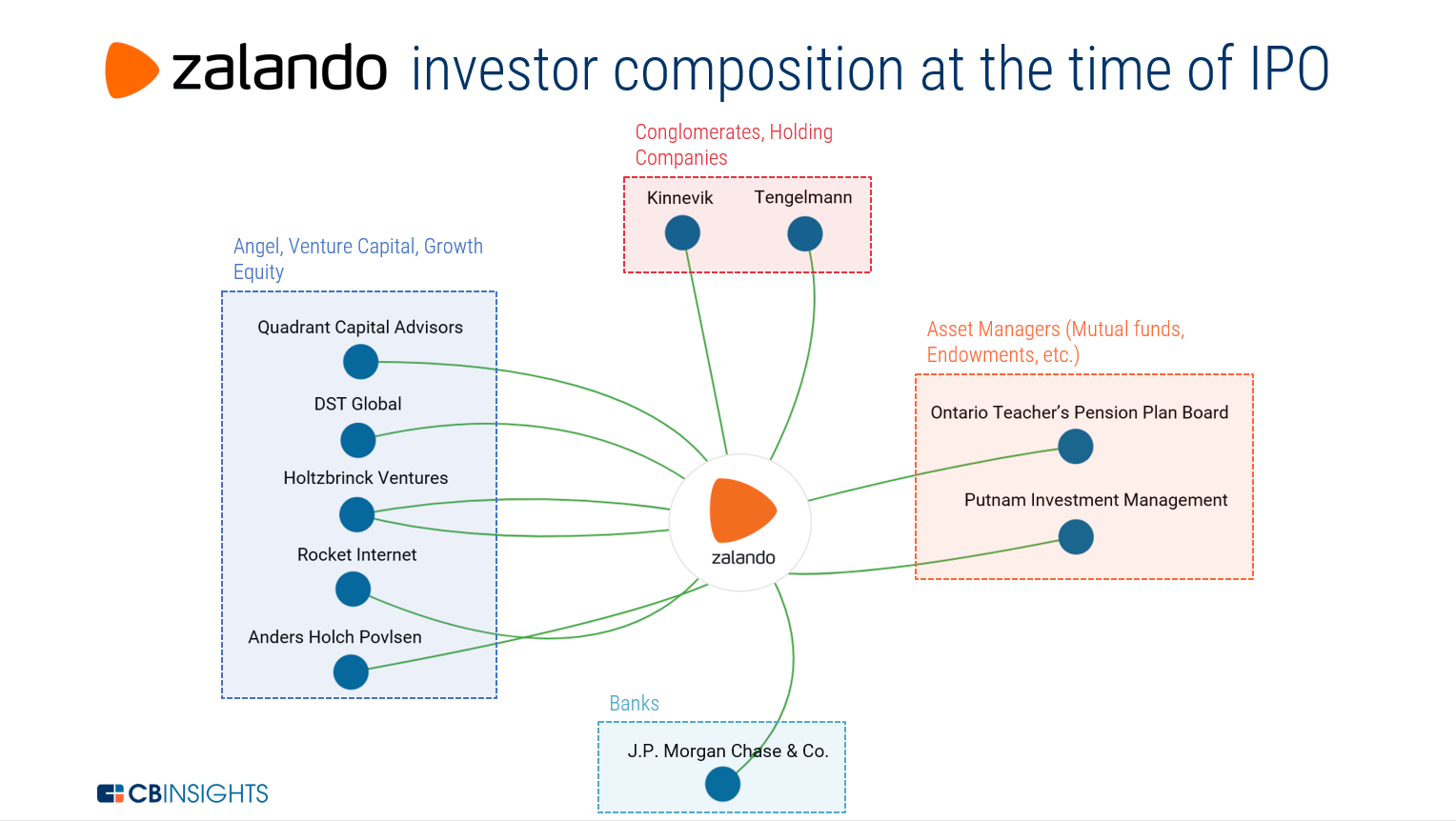

Venture capital and private equity firms raise pools of capital from accredited investors known as limited partners to invest in privately-owned companies. Their goals are to increase the value of the businesses they invest in and then sell them — or their equity stake — for a profit. For founders, securing venture capital means giving up equity and a chance they’ll lose control of their companies.

Covid-19 has reshaped the finance landscape as offline commerce continues to move online, according to FinTechMagazine.

Underwriting models meant for offline businesses often don’t translate to e-commerce businesses.

Increased demand for products from online platforms has brought opportunities for companies. “Those companies need financing solutions to keep up with that demand or risk stockouts and poor customer experience,” said Keith Smith, CEO and co-founder of Payability.

Taking on business debt may seem scary but it can be a wise reinvestment in your e-commerce business, said Michael Ugino, co-founder and chief marketing officer of marketplace management platform Sellbrite.

As the U.S. economy reopens, consumer-facing Main Street small- to medium-sized businesses are waiting to see if top lines and cash flows will return.

Startup Loan Options Outside Of Venture Capital Management

There are options to keep your equity. Here are six startup and e-commerce financing alternatives to venture capital.

Brex

Brex has created a corporate charge card for early-stage startups that rejects traditional underwriting methods. Instead of credit scores, it focuses on the funding of the business itself, Nerd Wallet reported.

There’s no personal guarantee and you don’t need to provide a Social Security number or pay interest, but you do have to pay the balance in full each billing cycle. The card connects to your corporate bank account which is automatically debited for the balance, so you need to have money there.

Brex says it can issue cards faster, and with higher limits (10 to 20 times higher) than other options. The card works on the Mastercard network, there are no annual fees or foreign transaction charges, and cardholders can earn rewards. It has perks and rewards for small business owners working from home to earn bonus points on services such as Slack, Zoom and food delivery.

Brex could be a good fit for startups that have a minimum of $100,000 in the bank, are comfortable giving Brex access to bank account and other funding information, and might need access to a high line of credit.

PayPal Working Capital

PayPal Working Capital is a business loan only available to PayPal sellers based on their PayPal account history, with no credit check required and no interest. Like the names implies, the funds can be used for day-to-day functions of the e-commerce business such as paying rent and payroll.

There’s a fixed fee for the loan. You pay a percentage of 10-to-30 percent of daily sales and you choose the repayment percentage. The higher your sales, the faster you repay. On days without sales, you don’t pay anything but you have to repay a minimum of up to 10 percent every 90 days to keep the loan in good standing.

You can expect to repay $0.01 to $0.58 in fees for every dollar borrowed (according to PayPal’s sample calculator), Merchant Maverick reported. Borrowers can’t save money by repaying the loan early.

Lighter Capital

/https%3A%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5f7ca2cdee0b559b0f92c713%2F0x0.jpg)

Seattle-based “alternative VC” firm Lighter Capital helps entrepreneurs raise funding without traditional venture capital. Since launching 10 years ago, it has invested $200 million in 350 U.S. companies using an innovative process known as revenue-based financing.

Revenue-based financing (RBF) lets early-stage startups raise cash without giving up equity or board seats, Geekwire reported. It’s a relatively new form of funding for tech companies that have monthly recurring revenue. The funding model “mixes some aspects of debt and equity. Most RBF is technically structured as a loan. However, RBF investors’ returns are tied directly to the startup’s performance, which is more like equity,” according to Lighter Capital.

“RBFs are essentially dressed up debt rounds,” Techcrunch reported. The difference is, “investors are more incentivized to help the companies they invest in because they are receiving a certain portion of that business’s monthly revenues, typically 1-to-9 percent. Eventually, as is explained thoroughly in Lighter Capital’s RBF report, monthly payments come to an end, usually 1.3 to 2.5X the amount of the original financing — a multiple referred to as the ‘cap.’ Three to five years down the line, any unpaid amount of said cap is due back to the investor. When all is said in done, ideally, the startup has grown with the support of the capital and hasn’t lost any equity.”

Lighter Capital says it gives access to up to $3 million in capital

Shopify Capital

Shopify Capital is a lending program for Shopify merchants with funding in two forms: loans and merchant cash advances. With loans, you get a lump sum and repay it over 12 months with payments automatically withdrawn from your account, Sellbrite reported.

The money can be used to buy more inventory, boost an advertising campaign, or fund a new venture such as expansion.

With cash advances, repayment is more closely tied to sales. Shopify lends you money in exchange for a percentage of your future daily sales.

In Q4 2019, Shopify Capital made $115.9 million in merchant cash advances and loans, 61-percent more than Q4 2018.

To qualify for Shopify Capital, you must sell on Shopify, be considered a low risk, use Shopify Payments or a third-party provider and process a minimum amount of sales, though Shopify doesn’t disclose exactly what this benchmark is.

It’s easy, repayment is simple and you don’t have to have good credit. However, Shopify’s repayment plans and interest rates can be expensive compared with other funding options—especially if your company grows quickly, according to Sellbrite. You also lose future revenue. Forecasted sales might look good but you’ll have to hand over some of your profits until the loan is paid back.

Payability

Only available to e-commerce sellers, Payability funds sellers on Amazon and other online marketplaces. No credit scores are needed, rates tend to be inexpensive, there are no extra fees and there are discounts for early repayment, according to a MerchantMaverick review.

Listen to GHOGH with Jamarlin Martin | Episode 73: Jamarlin Martin Jamarlin makes the case for why this is a multi-factor rebellion vs. just protests about George Floyd. He discusses the Democratic Party’s sneaky relationship with the police in cities and states under Dem control, and why Joe Biden is a cop and the Steve Jobs of mass incarceration.

There are two products. One works like invoice factoring by providing you with daily payouts for your marketplace sales. This means you don’t have to wait for weeks to get money earned from your sales. The other loan product is similar to a merchant cash advance. Payability purchases future sales and provides you with a lump sum payment.

Payability says it has provided more than $3 billion in funding to thousands of e-commerce sellers.

Fundbox

The typical small business has enough cash to pay 27 days of its usual bills, according to a study by JP Morgan Chase. Many take out loans to cover these payments — if they can get credit, Wired reported. During economic downturns, payments slow down and the “net terms” economy hurts small and medium-sized businesses.

San Francisco startup Fundbox offers a combination of a credit card and a payment system like PayPal for small businesses. Fundbox extracts data directly from a business’s bank and accounting software, using machine learning algorithms to predict whether a business will pay up.

Fundbox may be a good option if your business needs cash fast — as soon as the next business day — and you don’t meet requirements for other financing. But it requires a minimum annual revenue of $50,000 and at least three months of invoicing history with a supported accounting software or business checking account.

The credit score requirement has a low minimum — 550 — but rates are high compared to traditional banks, according to a Nerdwallet review. No personal guarantee is required for business lines of credit under $50,000, which means you’re not personally responsible for repayment if your business fails to repay a loan.

Also, Fundbox borrowers don’t have to provide collateral such as real estate for repayment of a loan.

Startup Law ResourcesVenture Capital, FinancingFiguring out the best way to fund your startup is difficult. Here we outline 12 of the best sources of funding that you can leverage to launch your startup.6 min read

1. Self-Funding / Bootstrapping2. Friends and Family Investors

3. Crowdfunding

4. Incubators / Accelerators

5. Angel Investors

6. Venture Capitalists

7. Loans / Credit Cards / Debt

8. Small Business Grants

9. Barter

10. Partnership / Licensing

11. Commitment to A Major Customer

12. Ask a Lawyer

Updated June 25, 2020:

It takes money to turn a great idea into a great product, but “money doesn’t grow on trees” and you may not have thousands of dollars just waiting to be spent. So how do you turn your dream into a reality? Here are some of the best options.

Self-Funding / Bootstrapping

Many entrepreneurs start with some level of self-funding (also known as bootstrapping) and, in fact, future investors likely will want to see that you have some “skin in the game”. Even if you can only put in a little money, it is worth considering the benefits. For example, you don't have to worry about keeping investors happy. You also can keep more profits to yourself. Many founders also hold off on taking a salary, consider tapping into the 401(k) retirement account, and/or have a side job to help make ends meet while they get their business up and running.

You also can use your initial profits to bootstrap future growth instead of relying on future funding rounds.

Friends and Family Investors

First, make sure you read our guide on raising money from friends and family investors and the dangers that your startup faces. Your friends and family may be willing to help you grow, and they probably wouldn't make you jump through the many hoops. These investments generally are some type of loans or stock purchases and are something later investors will likely find to be a positive (i.e., if your family and friends don’t believe in you, why should the investor).

However, to protect yourself and your relationships, make sure you have a clear written agreement that outlines how the money will be repaid. Also, remember that even if the arrangement is informal, you should confirm if any securities restrictions apply to the arrangement.

Crowdfunding

Crowdfunding is quickly becoming a popular way to help fund a startup.

However, before seeking crowdfunding, make sure you look at our guide on the various crowdfunding legal issues and tips on how to avoid legal mistakes.

In the traditional approach to crowdfunding, you offer a first-run product or some other incentive in exchange for a monetary contribution. Contributors receive no equity and are not entitled to be repaid.

In many cases, the process is essentially a pre-sale of your product and not an investment -- and not regulated by the federal Securities and Exchange Commission.

Equity crowdfunding is a newer option made possible under the Jumpstart Our Business Startups (JOBS) Act -- which allows you to seek small investments from a large number of investors. You use a crowdfunding platform to post a listing similar to a traditional crowdfunding campaign, but your investors become shareholders. This includes voting and dividend rights as outlined in the shareholder agreement.

If you're interested in equity crowdfunding, carefully review the requirements of the Jumpstart Our Business Startups Act because it is a regulated securities offering.

Incubators / Accelerators

Incubators and accelerators generally provide groups of startups with workspace, business advice and training, and potential funding. They are often sponsored by universities, industry organizations, or individual companies. You can learn more about what you should do to legally prepare for the accelerator program beforehand in our guide here.

Each startup gets support from the sponsor plus networking opportunities with the other startups. In exchange, the incubator or accelerator may take an equity stake especially if they provide funding.

You can find incubators and accelerators geared towards local businesses in most cities. Accelerators and Incubators with national recognition include the following:

Angel Investors

Marcus Lemonis from the TV show 'The Profit.'

Before seeking out angel investors, it is highly recommended to make sure that you read the guide on angel investors and the things startups must know and prepare for beforehand.

The upside is often a closer personal relationship that includes heavy mentoring. The downside is that an angel investor will often ask for a large equity stake and possibly even a controlling interest.

Typical investments frequently range from $25,000 to $250,000. Because angel investors operate with a smaller, less formal structure, they can have widely differing expectations of the terms of an investment. While getting a large investment offer is exciting, you need to make sure it's best for you.

Venture Capitalists

Venture capitalists are professional investors who invest in startups and growing companies. This makes them a receptive audience when you're looking for investors to pitch. However, you'll generally need to be past the earliest stages because the typical venture capital investment is $1 million or more. It may also take many months to close the deal.

It is highly recommended to read this guide on how to get venture capital and the most important things startups must do beforehand.

Make sure that your interests are aligned with a prospective venture capitalist. These firms often seek fast returns and push for rapid growth. This may go against your desire to build slowly and steadily.

Venture capitalists also seek, and regularly exercise, substantial control over a company. If you want to follow your own vision, venture capitalists may not be right for you.

It is further important to note that venture capitalists typically want to use their own investor agreement. As with any important contract, you should carefully review it to ensure it promotes your own interests and goals. Don't be afraid to negotiate changes or walk away if it doesn't.

Loans / Credit Cards / Debt

New businesses can find it challenging to get a traditional loan from a bank unless they have business assets for collateral and/or are willing to personally guarantee the loan (e.g., by putting up the equity in their house). However, the federal Small Business Administration (“SBA”) offers several small business loan programs that can help you get approved. Some entrepreneurs also may utilize credit cards, microloans or venture debt to finance their companies.

Once you have steady sales, you may be able to open a credit line against your accounts receivables (what customers owe you) (also referred to as “factoring”) or use your business equipment as collateral for a loan (also known as an asset loan).

Small Business Grants

Grants provided by the government or private organizations can provide free funding. To receive a grant, your company may need to be engaged in some sort of societal good or specialized area, such as education, medicine, or alternative energy. You can search for grants at grants.gov.

If you do receive a grant, there may be limitations on how you can use the money, and this could create an additional accounting burden for you.

Barter

Many businesses understandably prefer to be paid in cash, but there is still room for trade in the modern economy. Look for small businesses that can fulfill one of your needs and have a problem that you can solve. You may be able to trade your services in exchange for something you need (e.g., agreeing to do IT for a company in exchange for using their office).

Even if you don't directly receive cash, the savings will allow you to further stretch your resources.

Partnership / Licensing

Sometimes, growing on your own isn't the answer. Instead, you may want to create a partnership or licensing deal with an established company who can benefit from your product.

Startup Loan Options Outside Of Venture Capital Group

For example, if you invented a cell phone battery that lasted twice as long as existing batteries, you could: (i) go through the expensive and risky process of trying to market your battery independently to consumers, or (ii) strike a licensing deal with an established manufacturer who would love to put your battery in their next model.

Startup Loan Options Outside Of Venture Capital Companies

In a partnership or licensing arrangement, funding might be limited to an advance on a first order to help you scale up your manufacturing. However, the bigger win is that by reducing the costs of setting up your own supply chain and marketing strategy, you won't need as much funding.

Commitment to A Major Customer

If you can lock in a major customer, they may be willing to fund your development. In exchange, they may want to adapt your production process to their exact specs, receive exclusive distribution rights, or get dedicated support. This commitment may be tied into an early licensing deal or white-label agreement.

You'll also gain the advantage of reducing the risk of your investment by locking in a guaranteed minimum return.

Ask a Lawyer

The best funding option is ultimately a personal decision based on your unique goals and risk tolerances. Consulting with an experienced business lawyer who has seen many businesses succeed and fail can help you make an informed decision about what's right for you. Post your legal need through a job on UpCounsel to find a highly qualified lawyer in your area.