Savings 2 is an app that is a replacement for Quicken on Mac that aims to simplify by eliminating unnecessary features. It is also very affordable. I am the developer of this app. Moneyspire is a very complete alternative to Quicken on Mac which tracks bank accounts, credit cards, loans, investments and more. You can set bill reminders, budgets and generate detailed reports and charts to monitor your outgoings and if you run a small business, you can also create professional invoices and track payments.

- Quicken For Mac Replacement

- Quicken For Mac Replacement

- Best Quicken For Mac Replacement

- Quicken 2007 For Mac Replacement

Quicken is no longer the only game in town. This article uncovers 14 Quicken alternatives you can start using today. Simply put, if you’re searching for exceptional accounting software that integrates into your money management system, you’ll enjoy this post.

Let’s get to it.

Quicken had a lock on the market until the competition outpriced it. There are several versions of Quicken.

The basic version allows you to track and pay bills, set up bill alerts, automatically import transactions, categorize spending, create a budget, and generates your credit score.

Many of the alternatives are free.

Why Switch to a Quicken Alternative?

Since Intuit sold Quicken, no one is sure of its future. That desktop-based technology is becoming increasingly outdated, so it’s not outside the realm of possibility that they will discontinue the program.

It’s also been immensely underwhelming for many users since HIG Capital bought them in 2016. The software seems to lag behind the rest of the fintech universe.

If you want to use the Quicken mobile app, you still have to buy the software and sync it with your home computer.

If all this sounds like a hassle, check out some of the best alternatives for your money management.

Quicken Alternatives for Personal Accounting

1. Personal Capital

Personal Capital is our favorite, and it’s free to use. Whereas some quicken alternatives only focus on spending, Personal Capital also focuses on investment tracking and retirement planning. Your overview will show your expenses and your investment portfolio.

With Personal Capital, you can see your entirefinancial life in one place and get many powerful financial tools for free.

We’ve talked about how lethal fees can be to your savings, and Personal Capital has a fee analyzer to show how much you’re paying. The site will also help you set your asset allocation.

Personal Capital also has the typical budgeting software features like a list of upcoming bills. You will also get regular summaries of both your spending and your investing portfolio.

All you have to do is link your online banking accounts – checking, savings, credit, and investment accounts, and Personal Capital does the heavy lifting for you.

Personal Capital ticks a lot of boxes towards helping reach your financial goals.

It uses your financial data to help you plan for retirement and optimize your investment strategy. Here is our in-depth Personal Capital review if you want to know more.

Personal CapitalBudget like a business and focus on your cash flow. In addition to their budgeting software, they have an awesome suite of tools to help you optimize your investments. Did we mention it's free?

2. Moneyspire

Moneyspire is a great way to see your overall financial picture so that you can take control of your budget.

See all your of your account balances and transactions in one place and know precisely where your money is going.

Moneyspire also allows you to set up bill reminders, so you hopefully never forget to pay a bill again.

One of the best things about Moneyspire is that they respect your privacy.

Their online features won’t force you to put up your data or personal information. All information is kept on your computer.

One stand out feature of Moneyspire is there is no subscription. Once you buy, it’s yours to keep and use forever.

If you are already using Quicken and dread switching over to a new product, no worries; Moneyspire lets you freely move from your existing personal finance software with its extensive importing options.

MoneyspireEasy to use, powerful software to manage your money. See all your balances and transactions in one place with as much detail as you need. They even have customizable, interactive reports to help you understand everything about your finances.

Mint

Mint seems like the natural choice since Intuit owns it. It’s free and an excellent way to budget your money and track every dollar you spend.

We have recommended it for a long time. It’s easy to use and has a lot of convenient features that help monitor your spending.

It issues weekly spending summaries, fee alerts, notifications when you get close to and go over a budget category, and your credit score.

Your transactions sync automatically, so you don’t have to enter things manually. Bill Tracker allows you to receive notifications of bills due and lets you pay them online.

You can set up goals in Mint, things like saving for a down payment or paying off credit card debt and see your progress towards those goals.

Where it falls short is in its investment tools.

There are better services for that which we’ll explore. You can’t import data from another site or software into Mint, so if you’re using Quicken and want to continue to have access to that data, Mint will not be ideal.

While Mint mostly does the work for you, sometimes it categorizes expenses wrong, and you have to go in manually to correct them.

MintAn excellent free budgeting tool. I use it, and if you're getting started, you should too. If you don't track your spending, you'll never know where you're wasting money.

You Need a Budget

You Need a Budget (YNAB) is an online budgeting tool and a personal finance app that follows the zero-based budgeting system. The cost is $11.99 per month or $84 per year.

You can test drive it for a 34-day free trial.

If you need to pay off debt or if you have irregular income (freelancers, real estate agents, etc.), YNAB is a great system.

You are budgeting with the money you made the previous month, not the money you will be making the following month (aka aging your money).

YNAB uses the Four Rules when budgeting:

- Give every dollar a job

- Embrace your true expenses

- Roll with the punches

- Age your money

The budgeting tool for the person that budgeting doesn't work for. YNAB has a unique approach that's based on forming positive habits. Their Four Rules will stop you from living paycheck-to-paycheck. It also supports multiple currencies!

5. EveryDollar

EveryDollar is another zero-based budgeting tool created by Dave Ramsey. It lets you add your monthly income, plan expenses, and track your spending. The app has both a paid ($129 annually) and a free version.

Syncing your financial accounts and streaming transactions automatically is part of the paid version, EveryDollar Plus. This version also gains you access to Dave Ramsey’s Financial Peace University (call-back support and coaching calls).

6. CountAbout

CountAbout does allow you to import data from Quicken, so for many of you, no matter what else is good or bad about it, this is all that will matter. It isn’t free to use, but it’s not expensive either.

The Basic program costs $9.99 a year, and Premium is $39.99 per year. The basic service does not include automatic downloading of transactions from banks, credit cards, etc. so unless you want to enter data manually, you’ll need to pay for the upgrade.

CountAbout lets you track spending, create and manage budgets, and set your categories. However, you can’t transfer money between accounts or pay bills. It’s primarily a budgeting app and doesn’t offer investing help.

However, it does include a 15-day free trial for those interested in using the platform.

7. GNU Cash

GnuCash is a full-on accounting program, so if you want something that is more like a bookkeeping system and less like a budgeting system, this is a fine Quicken alternative.

GnuCash is free to download. It does have a budgeting feature that allows you to track bank accounts, stocks, income, and expenses. And it also handles small business affairs like multi-entry bookkeeping and printing checks.

It can import transactions and even give you stock quotes. You can set up several account types both for personal and small business including credit cards, investment accounts, accounts receivable and payable.

GnuCash has a lot of features for small business bookkeeping, including invoicing, billing terms, and payroll.

You can generate custom reports both for personal and small business finances like income and cash flow, net worth, income statements, receivables and payables aging, and balance sheets.

The only issue is that it’s not nearly as customizable as some paid-for rivals, especially when it comes to invoice design.

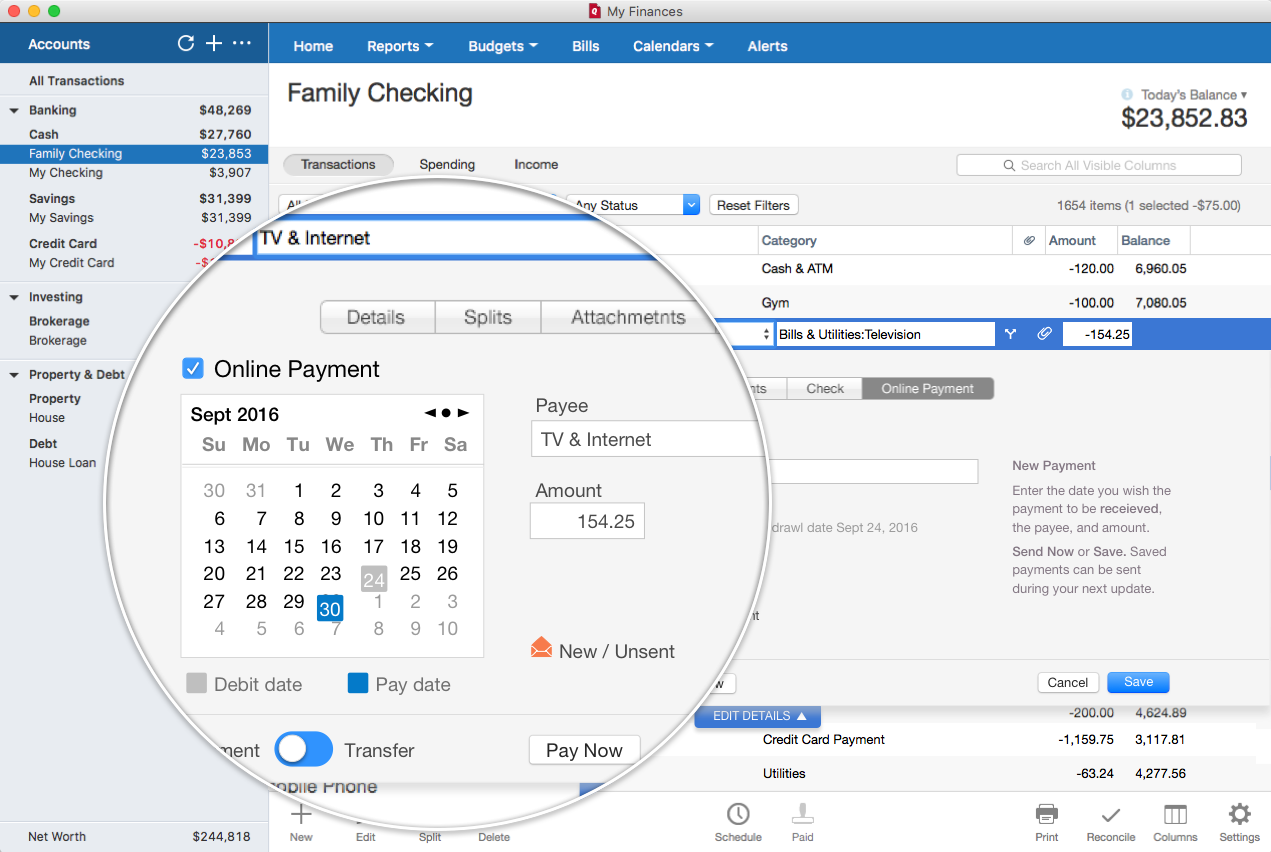

8. MoneyDance

MoneyDance is personal finance software for both Mac and Windows. Its online banking feature automatically downloads transactions, makes bill payments, and categorizes spending.

It also lets you generate reports to track income and expenses, set up payment schedule reminders, and follows your investments(both total value of investments and performance).

You can get the mobile app for either Android or iPhone devices. It currently costs $49.99 and comes with a 90-day money-back guarantee. MoneyDance also features a free trial, letting you manually enter 100 transactions.

9. Banktivity

Banktivity is personal finance software for macOS and iOS users. It boasts, on average, customers save over $500 a year and 40 hours of time.

It’s a digitized version of the old school Envelope system where you stuff cash into various envelopes and assign each envelope a category (e.g., rent, utilities, dining out). Once the money runs out of the envelope, you’re spending in that category is done.

Envelope budgeting with software.

Banktivity has a robust set of free resources including free weekly courses, their Personal Finance 101 blog, and a US-based technical support team.

Banktivity 7, its newest version, connects all of your accounts in one place, sells for $69.99, and comes with a 90-day free trial.

10. Tiller Money

Tiller is a budgeting spreadsheet that integrates with Google Sheets or Microsoft Excel. It automatically monitors transactions, spending, and account balances.

Subscribers get a pre-built dashboard and reports regarding financial insights, monthly and yearly sheets, net-worth at a glance, and customizable categories sheets. You can also see your money trends.

Because it’s cloud-based, you can share your template with both family and colleagues.

You can sign up for a 30-day free trial after which you’ll be charged $59 a year ($4.92 monthly).

11. PocketSmith

Connect to over 12,000 global financial institutions with automatic bank feeds for easier transaction imports.

Create your budget calendar to schedule future bills while every transaction is categorized. The “what-if scenarios” feature lets you see the impact of your financial decisions both short and long-term.

This feature comes in handy when forecasting into the future.

Their Flexible Budgeting lets you shape budgets based on relevant periods in your life and doesn’t need to start on the first of the month.

Track your net-worth. Use reports to track income and expenses. The cash flow statement breaks down your historical and future financial activity by month.

PocketSmith integrates with Mint and Xero. If you’re already using either one of those services, PockeSmith might be a good fit.

Subscriptions run monthly, quarterly, and annually. Prices range between $9.95 monthly to $169.95 annually depending on which package you buy. There is also a free option (their basic plan for the casual budgeter).

Want to get your money under control?This is our guide to budgeting simply and effectively. We walk you through exactly how to use Mint, what your budget should be, and how to monitor your spending automatically.

Quicken Alternatives for Business Accounting

12. FreshBooks

FreshBooks is cloud accounting software for both freelancers and small business owners. It sends invoices but also includes robust bookkeeping features and uses double-entry accounting.

There are three tiers of service ranging from $15 to $50 per month and a free 30-day trial for them all.

It’s a cloud-based service, so there is no financial software to download. You can invoice your clients (how many clients depend on the tier you subscribe to) and save the information for future invoices.

You can track outstanding invoices and re-send them automatically after 30 and 45 days.

FreshBooks works with several merchant account providers, including PayPal, Google Checkout, iTransact, and Authorize.net. It also integrates information from accounting programs like QuickBooks and Xero.

Apart from invoicing, FreshBooks features time tracking, expense tracking, and credit card processing.

13. Xero

Xero is a cloud-based accounting system founded in 2006. It is a real accounting program for small businesses, not just a budgeting system.

Three plans are ranging in cost from $9-70 per month, and you get a free 30-day free trial.

Xero can do the typical things a small business needs from an accounting program. Some of Xero’s features include invoicing, inventory tracking, standard and custom reports, payroll, bank reconciliation, expense claims, quotes, and sales tax.

Not all features are available at every tier.

There is also integration with hundreds of iPhone apps, like time trackers and point of sale apps like Square and PayPal so you can customize the system even more.

Xero doesn’t put a cap on the number of users, so all of your employees can access the service.

Your bank accounts and credit cards sync automatically. You can also transfer data from other programs like Quickbooks.

If you want to get value from Xero, you want to choose a plan above the Start Plan. You are allowed five invoices and 20 transactions a month, which is not going to be enough for most small businesses.

If you need your accounting system to handle payroll, make sure your state supports it, not all currently do.

14. Wave

Quicken alternative Wave is a cloud-based accounting, invoicing, and bookkeeping program. The program is free to use and comes with standard features like unlimited invoicing, expense tracking, personal and business accounting, and reporting.

There are additional features available for a cost. Payroll begins at $15 per month plus $4 for each employee.

You can process credit card payments through Wave for 2.9% plus $0.30 per transaction.

The ability to separate and track both personal and business accounts in one place makes Wave a standout.

Editor's Note

Wave is suitable for tiny businesses like freelancers or contract workers who don’t need all the extra features of more sophisticated programs.

Despite some upgrades, there are still complaints about downtime. If you want tech support either by phone or chat, it’s $19 per month. If your business starts to grow, it may outgrow Wave.

Our Recommendations for Quicken Alternatives

Personal Finances

If you are just using Quicken for your personal finances, make the switch to Personal Capital. It does everything you need to stay on top of your finances.

You will have access to great tools like the fee analyzer and asset allocation recommendations and the retirement planner.

You can budget, keep track of your expenses and your investments in Personal Capital.

Business Accounting

It’s hard to beat free and convenient, and Wave is both. This Quicken alternative allows you to have your personal and business accounting in one place.

It gives you much of what freelancers and contract employees need at no cost and is one of the simplest, most intuitive programs available.

Final Thoughts

There have been no announcements that Quicken will cease to exist, but if you’re nervous, you have time to try out some Quicken alternatives. If you have to stop using it, you’ll know which program to choose.

Managing money is hard, especially if you’re doing it on your own. Luckily, there is software out there that can help you plan out your expenses and keep track of your hard-earned cash.

One of the most popular ones out there is Quicken, a competitor and alternative to Mint. It’s a financial management program created by the people at Intuit.

But did you know there are other programs out there that can offer features the now 37-year-old Quicken’s software can’t?

In this post, we’ll be looking at the best Quicken alternatives out there, and even some free personal finance software replacement for Quicken.

Best Alternatives to Quicken

These are the most popular alternatives out there. Some of them have free features you can use but most of them cost money or require a monthly subscription. Most also offer a free 30 day trial.

InboxDollars: Paid over $57 Million to members to watch videos, take surveys, shop and more. Join InboxDollars Now and Get $5 Instantly!

Panda Research: Earn up to $50 per survey or offer completed. Join Panda Research Today!

Swagbucks: Get paid to watch videos, shop online, take surveys and more. Join Swagbucks Now & Get a $5 Instantly!

Smart App: Earn $15 a month just for installing their free app, plus loyalty bonus every three months! Join Smart App Now

Daily Goodie Box: Want free stuff? DGB will send you a box of free goodies (Free Shipping - No Credit Card). Get your box now!

Branded Surveys: This survey panel pays you $1 just for signing up today & they pay via PayPal within 48 hours! Join Branded Surveys

With that said, here are the best Quicken alternatives.

1. Banktivity

- Price: $69.99 (one time fee)

Available only for iOS, Banktivity is an app that allows you to condense your banking information into one place to make planning for the future easier.

2. Calendarbudget

- Price: $3.99/month

Calendarbudget is based around a simple idea: building a budget around a calendar. It’s available on the App Store and Google Play.

3. Chronicle

- Price: $19.99

Chronicle mainly functions as a reminder for bills, both present and future, and helps to keep track of your spending history. Chronicle has built-in support for multiple households, too! It is available for Mac, iPhone and iPad.

4. CountAbout

- Price: $9.99/year

If you have a Quicken account already, you can import all your information to CountAbout for free. They have a free 15-day trial, so you can get a feel for it before you buy.

5. Debitoor

- Price: starts at £4/mo

This one’s geared towards entrepreneurs, and has software to help build invoices, as well as keep track of expenses.

6. iFinance

- Price: $35.99 (for Mac) – $8.99 (for iOS)

This program is made specifically for Mac and iOS. It has a limited demo version you can download for free, so you can get a view of what iFinance has to offer.

7. Manager

- Price: $39/mo (Cloud version)

While a free option is available for this app, it has a cloud-based version that’s much more powerful and allows you to access your information from multiple devices.

8. Moneydance

- Price: $49.99 (one time fee)

Moneydance comes with the ability to handle multiple currencies, as well as a handy mobile app you can get on the App Store or Google Play.

9. Moneyspire

- Price: $29.99 (one-time fee)

Moneyspire sends you customizable reports on how your money is doing and how your finances change over time. The Pro version even allows you to create and track customer invoices.

10. MoneyWhiz

- Price: $14.99/year

Offers synced bookkeeping across multiple platforms, as well as a lot of automation tools to take care of any monthly payments that need to be kept track of.

11. Monzia

- Price: £48 annually

Based out of the UK, this is a resource for self-employed people who need help with their record-keeping. It requires a recurring membership, not a one-time purchase, so be aware of that.

12. Personal Capital

- Price: $ varies

Although Personal Capital is more centered towards investing than managing finances, it still is a great software like Quicken. After all, investing is part of money management.

It has two services, a wealth management app and ore importantly (for the purpose of this post) a free financial tracking app that does most of the things that Quicken does.

13. PocketSmith

- Price: $0.00 – $19.95/month

Pocketsmith has a clean, friendly UI and can not only keep track of your past and present finances but can project how you’ll be doing in the future.

14. QuickBooks

- Price: $15.00 – $50.00/month

Intuit’s latest paid program, this took over after they sold Quicken to a third party. They have a tiered payment system so you only pay for the features you need.

15. Receipts (Quicken alternatives for Mac)

- Price: $54.95

This program is only available for Macs, but it offers a wide range of features including support for scanners and automatic sorting of data.

16. Tiller

Quicken For Mac Replacement

- Price: $6.58/month

Tiller makes it easy to keep all your “financial life” in a spreadsheet, where it’s updated automatically each day. You can start with one of their many templates to create a customized template for yourself. They also offer a 30 day free trial.

17. You Need A Budget

- Price: $11.99/month

YNAB has teaching tools to not only help you make a budget but learn how to handle money yourself in the future. It also features a 34-day free trial, which isn’t too shabby.

Free Software Like Quicken

Looking for free alternatives? These are the best ones out there that you can use. Some of them are app-only options and others work on a desktop. It’s up to you to decide what kind will fit best for yourself!

18. AceMoney Lite

Quicken For Mac Replacement

Advertising itself as “the best free Quicken and Microsoft Money alternative,” AceMoney’s free Lite version offers a bunch of services (as long as you limit yourself to two accounts).

19. Bankin’

A free app available on the App Store and Google Play, Bankin’ allows you to categorize your spending and predict how much money you’ll have at the end of the month.

20. Cash Organizer

A simple, practical solution for finance management. It has a downloadable version for windows, as well as a web version that you don’t need to download!

21. Eqonomize

Eqonomize is a simple program designed to budget for small households, and is available for Windows and Linux.

22. EveryDollar

EveryDollar is a simple and easy to use software that lets you create a monthly budget quickly and easily. It’s a product from Dave Ramsey, one of the top money management experts.

There is a free and paid version. If you have a small business with more complicated finances, you might need the paid version, otherwise, the free version is great for personal money management.

For details and to learn whether it’s worth it or not, read our honest review of EveryDollar.

23. Expendy

Available only on Google Play, Expendy is a tool that can track your daily expenses by category as well as chart your income and expenditures.

24. Finice

Finice can help you chart your expenses, make a budget, and analyze how you’re doing financially.

25. FrontAccounting

FrontAccounting is free but encourages donations as it is run by a nonprofit. It’s a fairly unornamented, no-nonsense accounting program.

26. Gnuaccounting

A Java-based program that works across multiple platforms. It can integrate with your OpenOffice/LibreOffice accounts as well as your chipcard bank accounts and works on Windows or Linux.

27. GnuCash

Best Quicken For Mac Replacement

Available on Windows, iOS, and even Linux, GnuCash is a good alternative for those looking for a way to keep track of their bank, stocks, and expenses without adding another subscription service to their list.

28. Grisbi

Grisbi was originally created in the year 2000 by French developers, and the English translation is a bit wonky, but it’s a free open-source software available on Github.

Quicken 2007 For Mac Replacement

29. Hledger

This is a very simple, plain-text accounting software for people who want a no-frills and free budgeting app. Despite this, it supports multiple currencies and can produce balance sheets, income statements, and cash flow reports.

30. HomeBank

HomeBank is one of the most globally accessible software out there, having been translated into 56 different languages. It’s designed to be easy to use and offers support across multiple platforms.

31. KMyMoney

Created by the nonprofit KDE e.V., KMyMoney is a free open-source alternative to other financial software.

32. Kresus

View your transactions through easy-to-read charts, establish a budget, and even set up email alerts for specific events or transactions so you can stay on top of things!

33. Ledger

If double-entry accounting is all you need, this lightweight program is for you. Uses the UNIX command line, so if that’s your OS of choice, here you go!

34. Mint

Intuit’s newest financial management software. It’s free to sign up, and its user interface looks more polished than Quicken does to the point where people online, especially on Reddit, refer to it as the money management tool that is “like Quicken but better“.

35. Money by Jumsoft

Available only for iOS, Money offers a number of features for free but also has in-app purchases to access more services.

36. Money Dashboard

This app is built for users in the United Kingdom and uses the Pound as its currency. It allows you to transfer money and work with more than 40 banks and providers.

37. Money Journal

This app is only available from the Google Play store and offers in-app purchases (so it’s not exactly free), but it does offer a nice amount of features with a simple interface that you can use without purchasing anything.

38. Money Manager EX

This is a free, open-source software that you don’t even have to install. It can be run from a USB drive, so you can take it (and your data) anywhere.

39. Money Plus Sunset

This is Microsoft’s accounting program, so it’s only available for Windows. If you’ve used previous versions of Money Plus, this one is a good replacement for those, as they are no longer supported.

40. Pecunia

Originating from Germany, so you may have to use Google Translate on the site, Pecunia is an open-source program designed to be a secure way of keeping track of your banking data.

41. Skrooge

An open-source program based on KDE’s KMyMoney, Skrooge can run on more obscure operating systems like Linux, BSD or Solaris, in addition to the usual Mac OS and Windows.

Final Thoughts

There are a lot of programs similar to Quicken out there that can do what Quicken does, and a lot of them do it for free. It’s nice having a lot of options, but it’s important to take your time and find the right one for you, depending on your situation.

If you have a small household with only a couple of sources of income, it might be better to get a simple lightweight app that you can have with you and update as you go.

But if you run a business? It might be better to buy a program that has more features and can keep track of things like inventory and invoices.

Do you have a program other than Quicken that you use and didn’t see here? Tell us about it in the comments!